In a dramatic turn of events, the stock of DMart (Avenue Supermarts Ltd) plummeted by 9%, resulting in a staggering loss of ₹20,800 crore for its promoters, including Radhakishan Damani.

The decline came as a shock to investors, particularly following a report from ICICI Securities highlighting concerning trends in the company’s financial performance.

Q2 Results

The report noted that DMart’s revenue growth for the second quarter was a mere 14% year-on-year, marking the lowest growth the company has recorded in a single quarter to date.

This figure falls short of market expectations and raises questions about the retail giant’s ability to sustain its growth trajectory in a competitive market.

Moreover, the like-for-like (LFL) growth, which measures the performance of stores open for more than a year, stood at only 5.5%. This is a significant drop from previous high-single-digit growth rates, suggesting a slowdown in consumer spending and increased competition within the retail sector.

Market Reaction

The market responded swiftly to the news, with DMart shares experiencing a steep decline investors reacted to the disappointing growth figures. This sharp drop reflects broader concerns about the company’s future performance amid changing consumer behavior and economic conditions.

Implications for DMart

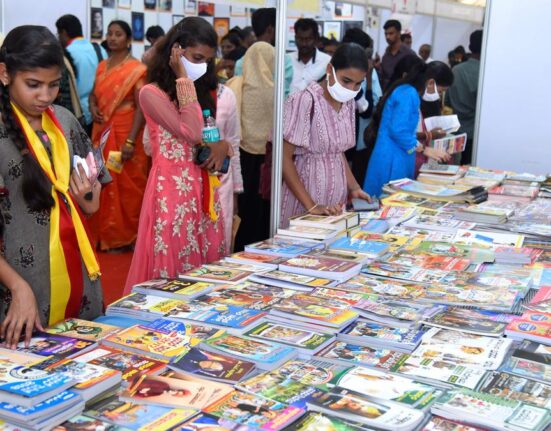

The latest figures signal potential challenges for DMart as it seeks to maintain its position as a leader in the Indian retail market. Analysts will be closely watching how the company adapts these challenges in the coming quarters, particularly in terms of pricing strategies, product offerings, and customer engagement.

As Radhakishan Damani and other promoters grapple with this significant financial setback, the focus will likely shift to how DMart can innovate and revitalize its growth strategy to regain investor confidence and improve its market standing.

In conclusion, the recent plunge in DMart’s stock highlights the volatility in the retail sector and serves as a reminder of the ongoing challenges faced by even the most established players in the market. The coming months will be crucial for DMart as it navigates these hurdles and strives to return to its previous growth levels.