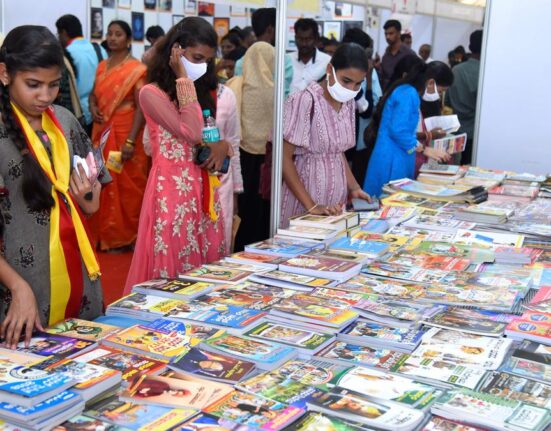

The investment culture in India is characterized by a growing interest in various investment avenues. With a rapidly developing economy, increasing disposable income, and greater awareness about financial planning, more individuals are looking to invest their savings to generate wealth and achieve their financial goals. However, it is true that a significant number of people in India often fail to research adequately before making investment decisions.

One of the primary reasons behind this phenomenon is the lack of financial literacy among the general population. Many people do not possess the necessary knowledge and understanding of different investment options, risk management strategies, and market dynamics. This knowledge gap often leads to hasty investment decisions based on incomplete information or unreliable sources.

Another contributing factor is the cultural mindset that favours speculative and quick-rich schemes. The desire for immediate returns and the fear of missing out on lucrative opportunities prompt individuals to invest in schemes that promise high returns without fully comprehending the associated risks. This mindset often results in impulsive investments without thorough research and due diligence.

Moreover, the proliferation of misinformation and unreliable investment advice further exacerbates the problem. In the age of social media and easy access to online information, it is common to come across unverified investment tips and recommendations that may not be suitable for everyone. Individuals often fall victim to the herd mentality, blindly following the investment choices of others without conducting proper research to understand the underlying fundamentals.

However, it is essential to note that the investment landscape in India is not entirely characterized by a lack of research. There are also numerous investors who diligently conduct thorough research, seek expert advice, and make informed investment decisions.

A financial or investment advisor plays a crucial role in guiding individuals through their investment journey and helping them make informed decisions. Here are some key reasons highlighting the importance of a financial or investment advisor:

Expertise and Knowledge

Customized Financial Planning

Risk Management

Diversification and Asset Allocation

Access to Investment Opportunities

Ongoing Monitoring and Review

Time and Efficiency

It is important to note that not all financial advisors are the same, and it is essential to choose a qualified and trustworthy professional. Look for advisors with experience, a good reputation, and consider the fees structure when selecting an advisor.

Planway Capital is an investment advisory firm which has built its reputation over the years with sheer dedication and hardwork that helped them build trust among their clients. Their expertise and experience has helped them grow into one of the leading investment advisory firms in South Gujarat.